Maximize efficiency, minimize costs

- Cancel anytime with no fees

- Flexible monthly payment options

- No disruption to your operations

- Policy transition with pro-rated refund from your existing coverage

Coverage designed for your unique challenges

- Protection against common industry claims, including dryer fires, slip and falls, water damage, and business interruption

- Unlimited certificates of insurance

- Easy policy management within your Cents Business Manager

- Fast claims management (typically within 48 hours)

- Expert guidance from Authentic Insurance licensed agents

- Backed by "A-Excellent" AM Best rated insurers through Everspan Insurance Company

Comprehensive protection plans

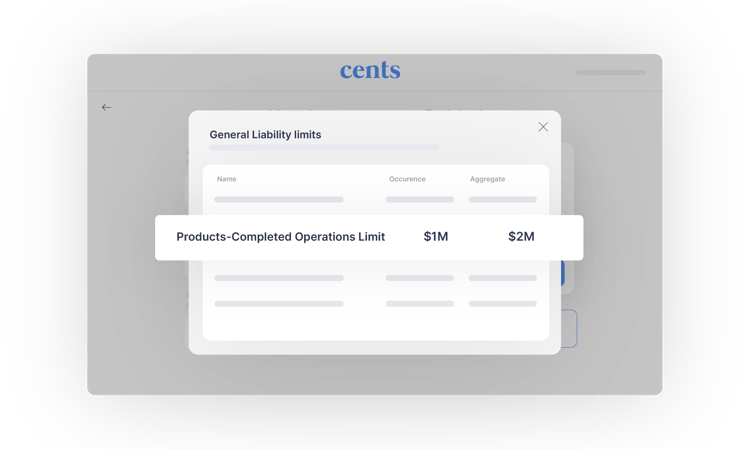

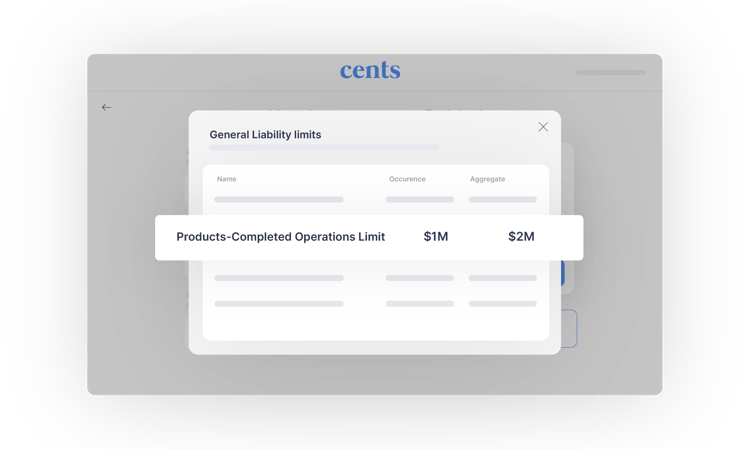

- General Liability Insurance: Protects against customer injuries, property damage, and legal disputes

- Property Contents Insurance: Protects physical assets from theft, fire, vandalism, and weather-related events

- Workers' Compensation Insurance: Covers employees for work-related injuries or illnesses

- Business Owner's Policy (BOP) Insurance: Combines General Liability and Property Insurance into a single package

- Hired and Non-Owned Auto (HNOA): Covers the usage of any vehicles not owned by the business, like employee vehicles

- Employment Protection Liability (EPL): Protects you against claims made by employees (past, present, or prospective) alleging violations of their legal rights

- Bailee’s Customers’ Goods Coverage: Protects customer garments in your care from loss or damage

Essential coverage for laundromat success

- Replacement cost coverage (not actual cash value) - The difference between getting full replacement or just depreciated value

- Adequate liability coverage for slip and falls

- Business interruption insurance that matches actual income

- Proper cash-on-premises coverage

- Customer goods coverage

Frequently Asked Questions

Authentic is an insurance infrastructure company that enables platforms like Cents to offer insurance to their customers.

We offer coverage in all U.S. states except Hawaii and Alaska.

Currently, we cannot cover 24-hour laundromats.

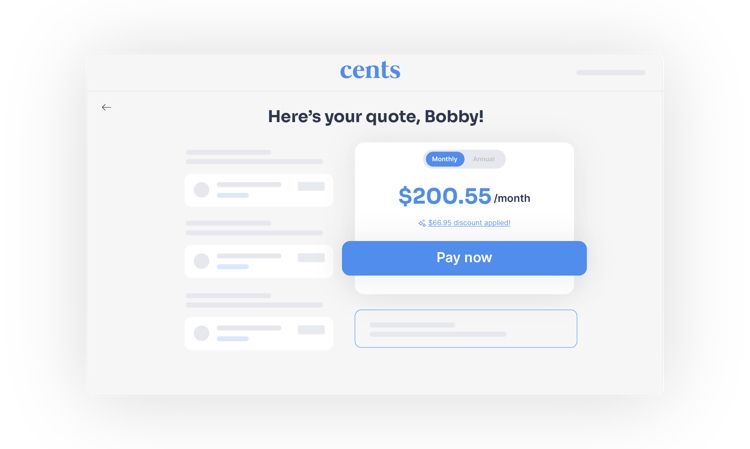

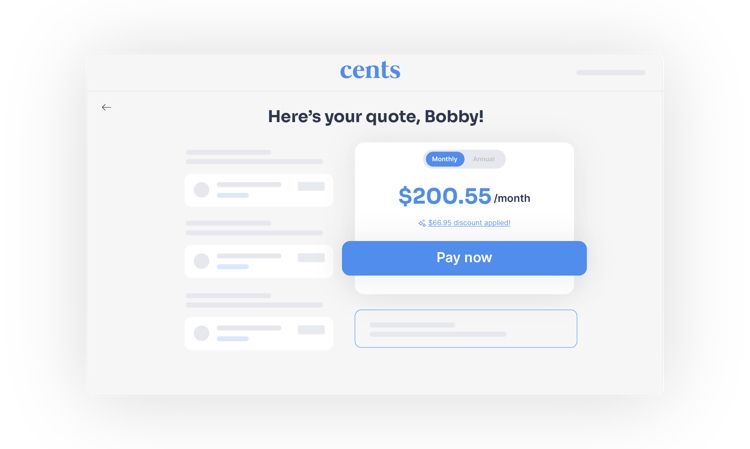

Factors include location, hours of operation, building structure, claims history, and risk mitigation practices. Cents is able to underwrite your specific laundromat needs to give you a personalized insurance experience.

-

Dryer fires: Often due to poor vent maintenance or customers putting oily rags in dryers

-

Slip and falls: Potentially costing $40,000+ per incident between settlement and legal fees

-

24-hour operations: Higher risk for unattended facilities

-

Location factors: Urban areas, high-crime neighborhoods, and shared buildings can increase risk

Many laundromat owners are unknowingly underinsured or overpaying due to:

-

Misclassification (e.g., being classified as a "drop station" rather than a laundromat)

-

Policies that exclude or severely limit water damage coverage

-

Inflation increasing replacement costs (~20% annually)

-

Regional pricing variations ($16-20K annually in NYC vs. half that in the Midwest)

Yes. Unattended operations (coin-only facilities with no staff) typically require additional coverage considerations:

-

Higher liability limits

-

Specific security measures

-

More comprehensive property coverage Attended operations generally receive more favorable rates due to reduced risk.

Yes. When leasing:

-

Your landlord may require you to insure building elements beyond your business operations

-

You'll need to list the landlord as an "additional insured"

-

You may need specific coverage for water and fire damage based on lease terms

We do not currently offer building coverage, so for owned buildings you may consider us for your General Liability and cover your property on a separate market.

-

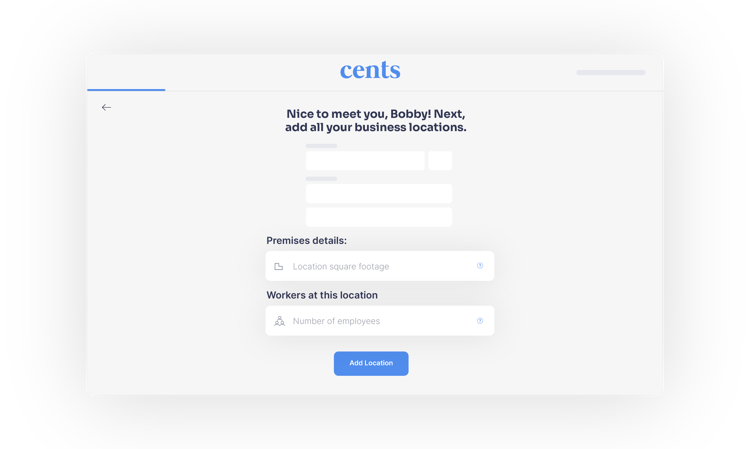

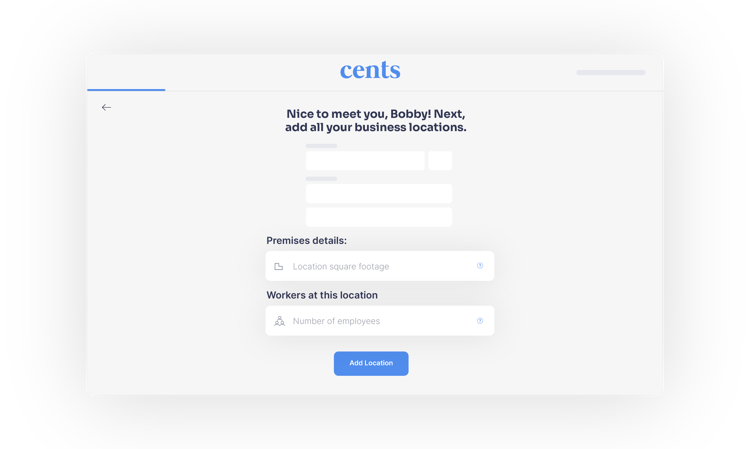

If your business has multiple locations, but with the SAME business type, you can add them all into one policy

-

If your business has multiple locations, but with MULTIPLE business types, we would recommend that you purchase each business separately

If your business has greater than $500K Business Personal Property, we recommend getting a quote and then speaking with an agent at the number listed in your policy hub. At this time, this requires additional approvals.

The dashboard integrates directly into the Cents Business Manager. Access your policy management hub through the email link sent after activation or by visiting the policy management hub found in the user dropdown menu in your Cents Business Manager and entering your security code.

For Laundroworks customers, the dashboard integrates directly into LaundroPortal and can be accessed on the lefthand navigation bar.

Once you sign up for a new policy with Cents Insurance, you can easily cancel your existing policy by entering your policy number and details, and we'll cancel it automatically for you.

You'll receive automatic notifications before renewal with opportunities to review and adjust coverage.

-

Professional vent cleaning every 2 years

-

Employee training on documentation and incident response

-

Camera systems with footage saved permanently after incidents

-

Regular policy reviews to adjust for inflation and business changes

-

Attended operations when possible

Contact our Cents Insurance Support Team at support+cents@authenticins.com or 509-516-2835

Explore more products

Insurance that speaks laundromat

Speak with a licensed Authentic Insurance specialist who understands the laundromat business inside and out.

.png?width=2196&height=2196&name=OS%20(1).png)

-3.png?width=224&height=213&name=Accelerate%20(2)-3.png)