When purchasing a laundromat, in-depth due diligence stands as a linchpin in the entire acquisition process. Without it, you risk being in the dark about important aspects of the business, potentially leading you to a completely inaccurate (and costly) valuation.

Laundromat due diligence is the comprehensive process of investigating and evaluating all aspects of a laundromat business before committing to its purchase. A mere $500 per month miscalculation could translate into a staggering overpayment of tens of thousands of dollars over time, harming your profitability.

If you’re willing to invest the time and care of proper, you’ll set yourself up for a truly promising venture! Laundromats make great cash-flowing investments, with an unleveraged return of 20-30% on average.

Laundromat due diligence is simple, albeit lengthy, but shouldn't be taken lightly! That's why we've created this ultimate guide covering every single step of laundromat diligence, so you can rest assured you've covered all your bases. By the end of this guide, you'll have all the knowledge and tools necessary to conduct thorough due diligence before sealing the deal.

Steps to buying a laundromat

Buying a laundromat is a smart investment, but research and informed decisions are necessary to make a sound purchase. Here are the high-level steps to buying a laundromat:

-

Determine your budget: Before you start looking for a laundromat, determine how much you can afford to spend. This will help you narrow your search and avoid overspending.

-

Review your lease agreement: Check if the laundromat is located in a leased space. Determine if the lease is transferable or if you need to negotiate a new lease with the landlord.

-

Check for permits and licenses: Check for any permits or licenses required to operate the laundromat in your area. Confirm that the current owner has all the necessary permits and licenses in place.

-

Evaluate the competition: Take time to assess the local competition and determine the demand for laundry services. Consider the proximity of other laundromats and the quality of services they offer.

-

Talk to customers: Talk to the current customers of the laundromat you're interested in buying. Ask for feedback on the services provided and any improvements they would like to see.

-

Seek advice: Get advice from experts like accountants, lawyers, other laundromat owners, and consultants. They can help you understand the finances, taxes, and laws related to your business.

-

Use the four pillars of laundromat due diligence: This is an absolutely essential step to guarantee the laundromat you're buying is a profitable and sustainable business opportunity. In the following sections, we'll explore each of these four pillars, complete with best practices and tips on how to conduct laundromat due diligence.

The four pillars of laundromat due diligence

To be confident that you're buying the right laundromat for a reasonable price, you need to consider each of the four pillars of laundromat due diligence. These include determining:

Understanding these four areas of the laundry business will give you the knowledge to make a wise business choice.

Pillar 1: Determining the laundromat's income

You've got your eye on a laundromat and you're ready to get down to brass tacks. This is where the first pillar of laundromat due diligence is useful, which involves finding out how much monthly recurring revenue the laundromat earns.

There are three methods you can use to get an accurate idea of how much money the laundromat makes:

-

Assess the utility usage

-

Collect the coins

-

Check the paper trail

1. How to Value a Laundromat

When purchasing a laundromat, you’ll want to verify how much income a laundromat is making. There are three main methods to determine a laundromat’s income:

-

Utility Usage Method

-

Coin Count Method

-

Document Method

Assess the utility usage

The first way to verify income is a thorough water analysis. This technique is not precise but will give you a decent ballpark figure for how much money a laundromat is making. Here are the steps to conducting a utility usage assessment

-

Laundromats house a variety of washing machines sizes. For each of these washing machine sizes, you'll want to know how many gallons of H2O they use during each wash cycle. It's a bit of a task but a necessary step in closely estimating your future laundromat's income.

-

Once you have your gallons tallied up, find the average number of cycles each machine runs per day.

-

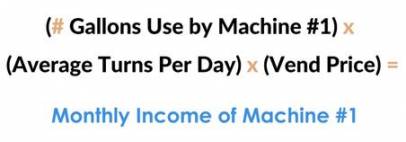

You've got your water usage stats and your daily machine spins—now, determine vend price. This is the price people pay for each wash cycle. With this number, you can calculate the monthly income for each machine size using this formula:

-

Repeat this formula for every machine size in the laundromat. Once you've got the individual numbers, you can crunch the grand total. Sum up the individual machine incomes and you've got your total wash income. Multiply that total wash income by 0.35 (or 35%) to estimate your dryer income.

This method should give you a ballpark figure close to the laundromat's reported income. Though not an exact science, you'll have a reliable picture of the financial potential of your potential laundromat investment.

Count the coins

A sure-fire way to know how much money is flowing into the laundromat is by simply counting it! This method is as straightforward and precise as it gets but involves a bit of patience. Over the course of several weeks, you'll diligently collect those coins alongside the laundromat owner. The idea is to build up a comprehensive picture of the laundromat's income stream through counting each dollar that comes through the door.

After a predetermined time frame, you'll be able to compare the total to what the seller has claimed as the laundromat's income. This hands-on approach allows you to confirm, without a shadow of a doubt, whether the financial figures add.

Check the paper trail

When verifying a laundromat's income, auditing the financial documentation offers a data-driven approach. This technique relies on obtaining and studying the seller's financial paper trail. While access to these documents may vary, it's an important step in your due diligence process.

Kindly request essential financial documents from the seller. These should include business tax records and bank deposit statements. Most sellers will be happy to provide their financial records to close the sale, but if they decline, this is your sign to proceed with caution.

While this shouldn't necessarily be considered a deal-breaker, it makes the diligence in due diligence even more crucial. Explore the other avenues to validate the income, such as analyzing utility usage and counting coins.

Pillar 2: Determining the laundromat's expenses

After getting a grasp on the laundromat's income, it's time to examine the other side of the equation—the expenses. Understanding the financial health of the business isn't just about the money coming in; it's equally important to know what's going out.

This step in laundromat due diligence involves requesting all documentation of expenses that keep the laundromat running smoothly, including maintenance, utilities, staffing, insurance, and taxes. Here four steps to verifying these expenses:

-

Request bills, statements and payroll information: Ask the seller for a comprehensive record of bills, statements, and payroll data. These documents will provide insights into the recurring operational costs.

-

Ask to see the lease and amendments/addendums: The lease agreement holds valuable information about the financial obligations you'll adopt in the sale. Make sure to examine the lease in detail, including any amendments or addendums that may impact expenses.

-

Verify expenses using a pro forma: Utilize a pro forma to assess and project future expenses based on historical data. This tool can help you anticipate and plan for ongoing costs accurately.

-

Harness the knowledge of experts: One of the best parts of investing in a laundromat is you don't have to go it alone! Seek the counsel of those who've come before you in the laundromat industry, such as fellow owners or consultants. Their insights can be invaluable in finding potential cost-saving opportunities and cutting back on expenses.

Pillar 3: Determining the laundromat's trajectory

With a firm grip on the laundromat's income and expenses, you're ready to tackle the third pillar of laundromat due diligence: assessing the trajectory of the business over time. This is important for valuing the laundromat, as it helps you use the laundromat's past performance to predict its future.

The steps to complete the third pillar include determining:

-

Income over time

-

Laundromat expenses over time

-

Utility expenses over time

The slope of these numbers will tell you if a laundromat is thriving, stagnant, or dying. Just as important as discovering the trajectory of the business is asking the question, "Why?" Why has the business been growing, stagnant, or declining and what can you do to supercharge its growth?

Determining the laundromat's income over time

Begin by scrutinizing the income trajectory. This takes into account the big picture of the laundromat's income over time while introducing the element of time into your analysis. Plotting the income over time can reveal telling insights. For instance, while the average income for the year might seem robust, a closer look at monthly income trends could uncover fluctuations or declines that require answers.

Consider this scenario: You receive financials from a seller indicating that the laundromat generated $100,000 in gross income over the past year, with a net income of $20,000.

Now, add a time-based perspective. When you examine monthly income data, you may uncover a different story. While the average annual income is $100,000, this figure doesn't always reflect the laundromat's real-time performance. It's entirely possible that income has declined over the past year, and the current monthly earnings could be substantially lower than at the start of the year.

Determining the laundromat's expenses over time

Next, apply this method to expenses over time. Gross income is only part of the equation; what truly matters is the net income. To calculate the net income accurately, take a look at the behavior of expenses over the same timeframe as you used to analyze income.

For example, imagine a scenario where income dipped significantly in a particular month, but so did expenses. This might suggest a healthier financial picture than meets the eye. Expenses and income decreased in tandem due to factors such as cost-cutting measures, improved operational efficiency, or seasonal fluctuations in customer demand. Much like in the previous step, be sure to dig deeper when notable fluctuations arise.

Determine the utility expenses over time

The final piece of this step involves tracking the trajectory of utility expenses over time. Typically, utility bills should fall within 15-20% of the gross income. Plotting these numbers alongside income trends can provide insights into whether the laundromat's operational efficiency is on track.

As you analyze the utility expenses, always keep "Why?" in your arsenal. If these expenses deviate from the expected trajectory, it's a signal to investigate further. Always buy with your eyes wide open!

Pillar 4: Determining value-add opportunities

Laundromats are valued based on the net operating income (also called gross income) minus expenses. The fourth pillar of laundromat due diligence invites you to create a plan to enhance your laundromat's value and potential for growth. This can manifest in many prosperous ways, such as tapping into new revenue streams, expanding your market presence, or enhancing the overall customer experience.

Finding new ways to increase income in your laundromat has a two-fold benefit to you:

-

Your net income goes up. This results in more money in your bank account every month.

-

You build equity in your business. This results in your net worth increasing.

There are four main categories where you can add value to your laundromat:

-

Improve management: Look for ways to improve the management of laundromat employees, service delivery to customers, finances, and overall business operations. Collecting and centralizing performance data empowers you to make more informed decisions, set accurate goals, and optimize business operations.

-

Add revenue streams: New laundromat owners have the opportunity to explore additional revenue-generating opportunities. This could mean introducing new services like pickup and delivery or wash-and-fold, adopting innovative operating models, and broadening your income streams by incorporating a café or bar element into your business. Subscription models, luxury laundry services, beverage service, and delivery options not only boost revenue but also enhance the overall customer experience.

-

Offer new services: Expanding your service offerings can take your laundry business to a whole new level. Introducing new services or upgrading existing ones can attract a wider customer base and increase customer loyalty. The key is to identify services that align with your market and customer preferences.

-

Trim expenses: Beyond utilities, there could be areas where you can trim operating costs that may have gone unattended by a burnt-out former owner. For instance, streamlining business management solutions through technology can save time and reduce expenses. Finding integrated solutions that cater to multiple aspects of your business can result in significant cost and time savings while optimizing service delivery.

Negotiating the deal

As you complete your laundromat due diligence, you should plan to use what you've learned to negotiate a deal that benefits you. Here are some key considerations to help you navigate this process, leveraging your due diligence findings to secure the sale.

Due diligence timeframe: Due diligence typically spans several weeks to a couple of months, influenced by factors like laundromat complexity and seller cooperation.

Key negotiation factors:

-

Price vs. value: Distinguish between the asking price and the true value based on your due diligence. Aim for a price that reflects the laundromat's actual worth.

-

Seller's motivation: Understand the seller's motivations, which can mold your offer strategy.

-

Flexibility: Identify the areas where you're willing to compromise and seek mutual benefits during negotiations.

-

Contingencies: Include safeguards in the contract to protect your interests.

How to leverage your due diligence findings

You've done all this work to investigate the laundromat and get an honest idea of its true value, so be sure to use that information during negotiations:

-

Present facts: Use concrete evidence from due diligence to support your negotiation strategy.

-

Highlight risks and opportunities: Be transparent about risks and growth possibilities.

-

Set realistic expectations: Factor findings into negotiations while remaining open to compromise.

Download: Laundromat Due Diligence Checklist

In your journey toward laundromat ownership, due diligence stands as one of the most important steps that has the power to define your future profitability. No matter what your financial goals are, conducting proper laundromat diligence will lay the foundation for your success.

.png?width=2196&height=2196&name=OS%20(1).png)

-3.png?width=224&height=213&name=Accelerate%20(2)-3.png)

![A Buyer's Guide to Laundromat Due Diligence [Checklist]](https://www.trycents.com/hs-fs/hubfs/The%20Cents%20Guide%20to%20Laundromat%20Due%20Diligence%202.jpg?width=960&name=The%20Cents%20Guide%20to%20Laundromat%20Due%20Diligence%202.jpg)

.png?width=400&height=200&name=Thumbnail%20(3).png)